Irs 1040 Schedule C 2024 – The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual . Hi there, I help in providing the Tax forms as details given below. W2 and W3 Schedule C for self employed 1040 Tax Form (2 Pages Only) 1099 Independent Form 940 and 941 Payroll Form Payroll Report .

Irs 1040 Schedule C 2024

Source : carta.com

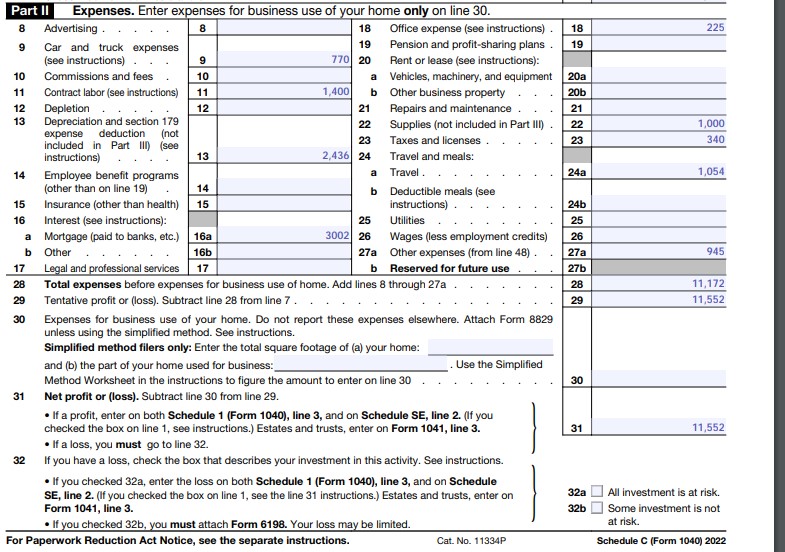

How To Fill Out Your 2022 Schedule C (With Example)

Source : fitsmallbusiness.com

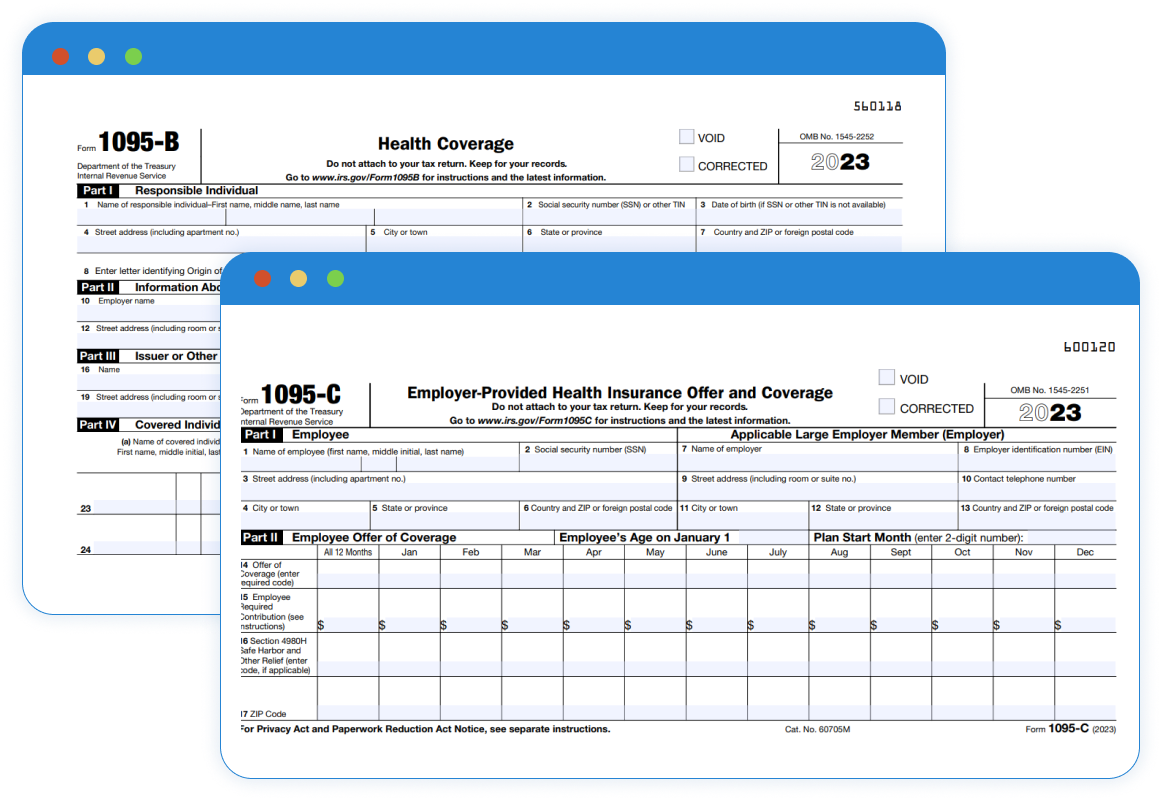

The IRS Releases Final Version of Form 1095 B & 1095 C for 2023

Source : www.acawise.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

What Is a Schedule C IRS form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Property Tax Listing – Town of Milton, Buffalo County, Wisconsin

Source : townofmiltonwi.gov

Form 1099 K: Definition, Uses, Who Must File

Source : www.investopedia.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Clocktower Players Scholarship Application

Source : www.clocktowerplayers.com

3.11.10 Revenue Receipts | Internal Revenue Service

Source : www.irs.gov

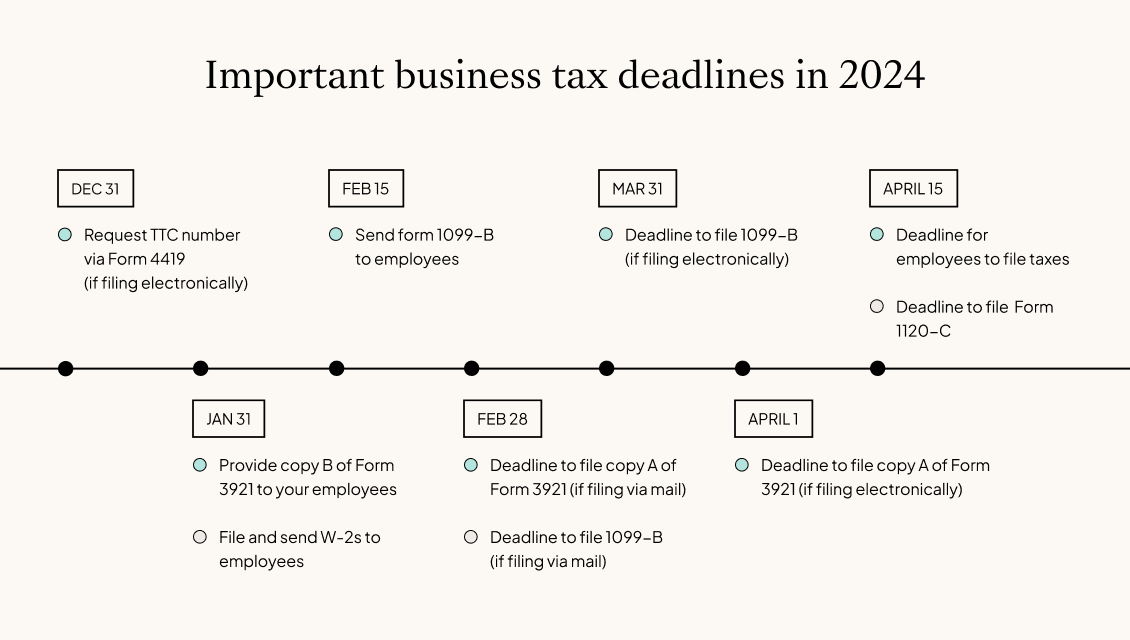

Irs 1040 Schedule C 2024 Business tax deadlines 2024: Corporations and LLCs | Carta: tax form that is used to report income and expenses for a business. Schedule C must accompany Form 1040, which is a taxpayer’s main tax return. Self-employed individuals, sole proprietors of a . The IRS announced new income limits for seven tax brackets on Thursday, providing some taxpayers breaks for 2024. The tax brackets are being adjusted upward by 5.4% using a formula based on the .

:max_bytes(150000):strip_icc()/ScreenShot2022-01-24at10.05.23AM-cf89715f09964cbca096821b63196735.png)